Moves like BPTH only come around once or twice a year at most. In case you missed it, BPTH ran from about $7 a share to $73 a share in just 1 and a half trading days. These types of moves are called supernovas.

These moves offer amazing opportunities on the way up, and on the way down too if you can locate shares to short. These opportunities don’t come along often, but if you know how to capitalize on them, a few well-executed trades on them can make your whole year’s worth of pay.

You are probably wondering why this happened, how to anticipate these moves, and how to capitalize them. We will answer all of these questions in this article, and in our recent trade recap:

https://www.youtube.com/watch?v=5jn5BiHSDYY

Moves like BPTH only come around once or twice a year at most. In case you missed it, BPTH ran from about $7 a share to $73 a share in just 1 and a half trading days. These types of moves are called supernovas.

These moves offer amazing opportunities on the way up, and on the way down too if you can locate shares to short. These opportunities don’t come along often, but if you know how to capitalize on them, a few well-executed trades on them can make your whole year’s worth of pay.

You are probably wondering why this happened, how to anticipate these moves, and how to capitalize them. We will answer all of these questions in this article, and in our recent trade recap:

https://www.youtube.com/watch?v=5jn5BiHSDYY

Why BPTH Shares Increased 10x in 48 Hours

There is a concept called float rotation which is essential to understand when trading small cap stocks. A stock’s float is the number of shares that are available to trade on the open market. Float rotation occurs when a stock has traded more shares in volume than its total float. This is what happened with BPTH. Everyone knows that this is a junk company that is overvalued. But its float is under 1 million shares (Shortsqueeze.com estimates its 526,500 shares). On March 6th when it ran from $7 to $14, it traded 72.4 million shares, which means it’s float rotated about 145 times. On the 7th when it ran to $73 it traded 36 million shares. At this point, it just becomes a trading vehicle, and fundamentals go out the window. There are a low supply of sellers because of the low float. Once it gets momentum and volume coming in, it doesn’t take much buying power to send it into orbit. There was no major trend break until it had a parabolic, blow-off-top move, which always ends the way: With a huge crash.All End the Same Way

Some recent supernova examples to study: MBOT, LFIN and DRYS. You will notice the exact same pattern in both of these names as BPTH. Once the tops were in, they gave up more than 50% of its gains in just a few hours. You want to be careful trading these after they have already made a big move up. These stocks will often get halted once they have gone parabolic, and then reopen at much lower prices. The more extended a stock gets in these scenarios, the riskier it is to buy them. Look at its intraday to see how quickly it crashed once the top was in: When trading a low float name, you don’t buy it with the expectation that the stock will go up 1000%. You want to take your gains after you get a “normal” sized move in your favor, and leave some shares on for the home run. If you hold your whole position for a home run type move like this you will lose 95% of the time.

When trading a low float name, you don’t buy it with the expectation that the stock will go up 1000%. You want to take your gains after you get a “normal” sized move in your favor, and leave some shares on for the home run. If you hold your whole position for a home run type move like this you will lose 95% of the time.

Scaling Out

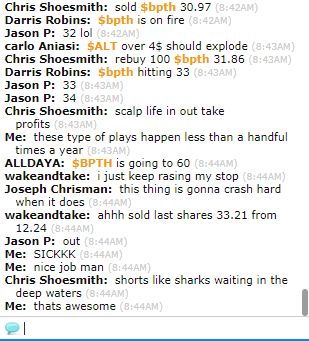

The best way to capitalize on these types of moves is to scale out into strength. This means to sell partial shares of your position as the trade goes in your favor. Many of the traders in our BOWS chatroom were taking profits into strength. Don’t go in with the expectation of trying to catch the exact top, especially when it starts getting overextended like it was. Here’s an example of how one of our students traded BPTH: He took his initial position in the $12’s, and scaled out into strength and held his last lotto shares for the $30’s. He played it perfectly. He sold a quarter of his shares in the 114’s to eliminate some overnight risk on the 6th, and then another quarter in the 20’s when it opened the next day. He held the last quarter of his shares for the home run trade and sold the last at $33.21.

He didn’t get the exact top, but he still made a great gain. Notice how he took profits as the market moved in his favor. This is the way to play these. Leave a small portion of your position for the home run, and take partial profits into strength.

He took his initial position in the $12’s, and scaled out into strength and held his last lotto shares for the $30’s. He played it perfectly. He sold a quarter of his shares in the 114’s to eliminate some overnight risk on the 6th, and then another quarter in the 20’s when it opened the next day. He held the last quarter of his shares for the home run trade and sold the last at $33.21.

He didn’t get the exact top, but he still made a great gain. Notice how he took profits as the market moved in his favor. This is the way to play these. Leave a small portion of your position for the home run, and take partial profits into strength.